Mastering the Dip and Rip Day Trading Strategy 20025

Learn the ‘Dip and Rip’ day trading strategy with detailed trade examples, market insights, and performance analysis. Master quick, profitable moves

Introduction to the Dip and Rip Strategy

In today’s episode, I’m going to teach you a day trading strategy called the “Dip and Rip.” This setup is one of my favorites, particularly when trading on the one-minute time frame.

The reason I like it so much is that, when a stock is incredibly strong and moving up rapidly, you don’t always get a nice, clean, and slow-moving pullback. Often, the only way to participate in the move is to jump in relatively quickly. The dip and rip strategy involves buying the dip and then selling into the first rip near the next half-dollar or whole dollar.

Performance Summary

As of now, I am up $1,536, with five out of the seven stocks I traded showing positive returns. I’m impressed because VRAK is up over 120%, and GOVX is up another 50%. These stocks were boosted significantly last Friday and Monday, showing continuation in the biotech sector. However, given that Monday was exceptionally strong and Tuesday was a bit choppier, I felt the need to be cautious today.

I was concerned about stocks popping up only to reverse, which made me more aggressive with the dip and rip strategy. I aimed to capture the initial leg of the move, knowing that if I missed it, there might not be a second chance to move higher.

Detailed Trade Analysis

RB Trade

When I first sat down this morning, I pulled up my scans and saw that RB was a significant gainer. I checked it on my phone around 6:30 AM and noticed it had a large spike at 4:00 AM but had been selling off since then. By 6:00 AM, it was back up to VWAP (Volume Weighted Average Price) and then sold off again.

At 7:00 AM, there was a surge in volume, which pushed the stock back up. I decided to trade during this surge and ended up making $2,000. The setup involved buying the dip after the red candle and capitalizing on the rip that followed. On the one-minute chart, I zoomed in to see the dip and rip more clearly, buying at $2.23 and making a significant gain as the stock squeezed through levels.

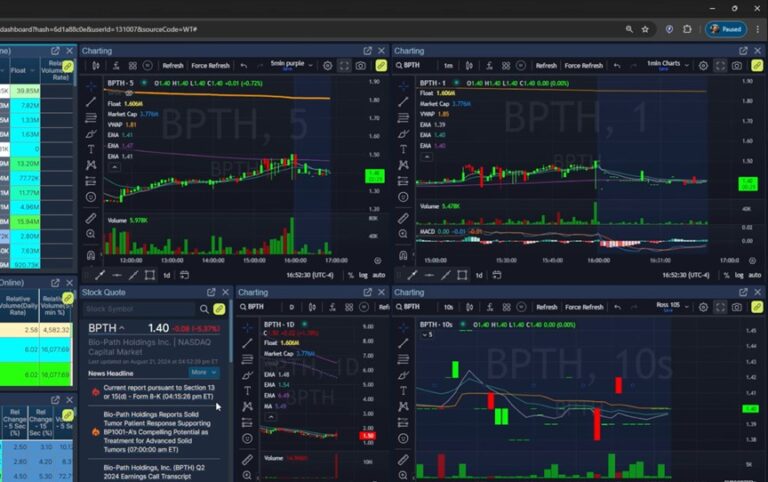

BPTH Trade

Next, I focused on BPTH, which had news that morning. I was cautious because BPTH has a history of volatile price action with large red candles. Despite my reservations, I decided to trade it. Initially, BPTH squeezed up to $3.20 but then pulled back. I bought the dip at $2.93, adding at $2.97. The stock moved up to $3.30, where I took profits. Although BPTH showed some weakness, I managed to exit with a profit. I attempted another dip trade around $2.50, but it didn’t bounce as expected, so I exited due to the stock’s overall weakness.

MNPR Trade

MNPR, with a 1.6 million share float, was another stock that appeared on my radar. It had a green candle on the daily chart, and I had traded it before, though it’s known for being a bit choppy. MNPR initially popped to $3.80 but then pulled back. I bought the dip at $3.52, adding at $3.56, targeting $4. The stock broke through $4 and surged to $4.90. This trade ended up being my biggest winner of the day, where I made over $1 per share. I was impressed with how well it performed and ended up locking in a substantial gain.

SMFL Trade

SMFL came up next, but it was a challenging trade due to its choppy nature. It squeezed up, pulled back, and I made my initial entry at $0.94. My first trade on it gave me a small win, but it became tricky. I took several stabs at trading SMFL before it broke $2. I managed a profit, but the trade was not as smooth or profitable as I hoped. I found myself frustrated with the amount of effort and churned a lot of shares for a smaller win.

SS Trade

At the open, I observed SS, which had shown some strong price action. I bought in at $7 and added at lower levels, eventually taking profits as the stock reached a high of $7.60. This trade was strong and successful, but I faced losses on SN and VRAK. I entered SN at around $0.38, hoping for further gains, but stopped out when it fell back. Similarly, I lost on VRAK due to a poor entry point, even though the stock made a significant move.

Market Overview and Circuit Breakers

Throughout the day, several stocks hit circuit breakers, including VRAK and GOVX. The dip and rip strategy is also useful when stocks halt and then open, often taking a quick dip and a rip. In the afternoon, the market showed some mixed signals. GDC, a stock with a headline about opening a TikTok shop, performed significantly but wasn’t a stock I traded. I avoided it due to its unpredictable price action and missed out on potential gains.

Overall Market Insights

Today’s market was volatile, with a notable number of circuit breaker halts. The S&P 500 also showed some volatility, with a lot of back-and-forth movement. This choppiness reflected a somewhat extended market, suggesting a possible pullback might be on the horizon.

As I look forward to tomorrow, my plan remains to watch the top gainers and wait for solid setups before jumping in. Despite today’s mixed results, the dip and rip strategy proved effective for capturing initial gains.

Conclusion

In conclusion, today’s trading was a mix of strong setups and challenging conditions. By focusing on the dip and rip strategy, I managed to secure gains despite some volatility in the market. I’ll continue to monitor top gainers and adapt my strategy based on market conditions. As always, trading involves risks, and results can vary.

Manage your risk carefully, stay patient, and I’ll be back streaming tomorrow morning to tackle new opportunities. For those interested in joining the Warrior Pro program or starting a trial, check the pinned comment and description for details.